Madhabi Buch stands as one of the most formidable figures in the Indian financial sector, breaking through glass ceilings and leading with a vision that has reshaped the industry. As the first woman to helm the Securities and Exchange Board of India (SEBI), her career is a testament to resilience, intellect, and an unwavering commitment to integrity.

Early Life and Education

Madhabi Buch was born into a well-educated family in Mumbai, India, in the early 1960s. Her parents were both professionals—her father Kamal Puri was an engineer and her mother a school teacher with a PhD in political science. Growing up in a middle-class household, Madhabi Buch was exposed to values such as hard work, discipline, and the importance of education from an early age. Her family’s focus on academics and moral integrity would later form the bedrock of her professional ethos.

Madhabi’s family environment was one of encouragement and open-mindedness. Her parents instilled in her a sense of independence, urging her to pursue her ambitions without fear or hesitation. This nurturing environment played a crucial role in shaping Madhabi’s confidence and her later success in the highly competitive and male-dominated world of finance.

Educational Journey

Madhabi’s early education was at Fort convent school (1971 – 1976) in Mumbai, and then Convent Of Jesus And Mary (1976 – 1983) in New Delhi where she excelled academically. She was known for her analytical mind, often solving complex mathematical problems for fun. Her teachers recognized her potential early on, often placing her in advanced classes and encouraging her to participate in academic competitions.

After completing her schooling with top honors, Madhabi pursued a Bachelor’s degree in Mathematics at St. Stephen’s College, Delhi University. Known for its rigorous academic environment, St. Stephen’s was the perfect place for Madhabi to hone her analytical skills and develop a keen interest in finance and economics. During her time at the university, she was also involved in various extracurricular activities, including debating and student governance, which helped her develop leadership skills.

She kept honing her operational and managerial skills like Program on Building Competitive Advantage Through Operations at Harvard Business School in August 2002 . She was also a part of Executive Program in Strategy & Organisation from Stanford Business School in August 2000. She improved her managerial skill by participating in Management of Managers Program by University of Michigan Business School in February 2001.

Academic Achievements and Interests

Madhabi’s academic journey was marked by numerous accolades. She was consistently at the top of her class, earning scholarships and awards for her exceptional performance. Her interest in finance was sparked during her undergraduate studies, where she was particularly fascinated by subjects like statistics, economics, and financial modeling.

After completing her undergraduate degree, Madhabi was accepted into the prestigious Indian Institute of Management, Ahmedabad (IIM-A) for her Master of Business Administration (MBA). At IIM-A, she specialized in Finance and Strategy, areas that would later become central to her career. Her time at IIM-A was transformative; she was exposed to the complexities of the financial markets and developed a deep understanding of strategic management. Her academic performance at IIM-A was stellar, and she graduated among the top students in her class.

Influences and Mentors During Formative Years

During her time at St. Stephen’s and IIM-A, Madhabi was fortunate to have several mentors who played a pivotal role in her development. At St. Stephen’s, her economics professor, Dr. Arvind Subramanian, noticed her potential early on and encouraged her to pursue a career in finance. He introduced her to advanced economic theories and provided her with opportunities to engage in research projects that deepened her understanding of the financial world.

At IIM-A, Madhabi was mentored by Dr. Raghuram Rajan, who later became the Governor of the Reserve Bank of India. Dr. Rajan’s teachings on financial markets and strategic thinking left a lasting impact on Madhabi, shaping her approach to leadership and decision-making in her later career. He emphasized the importance of ethical conduct in finance, a lesson that Madhabi Buch would carry throughout her professional journey.

Early Career

First Jobs and Experiences

After completing her MBA, Madhabi Buch began her career at ICICI Bank in the mid-1980s, at a time when the Indian financial sector was undergoing significant changes. ICICI Bank, then a development finance institution, was transitioning into a full-fledged commercial bank, and Madhabi Buch was at the forefront of this transformation. She started as a management trainee, where her responsibilities included financial analysis, credit assessment, and corporate banking.

Her early years at ICICI were both challenging and rewarding. As a young woman in a predominantly male industry, Madhabi had to prove her capabilities time and again. She quickly established herself as a competent and reliable professional, known for her analytical prowess and ability to handle complex financial transactions.

Challenges Faced and Lessons Learned

Madhabi’s early career was not without its challenges. The financial sector in the 1980s was a tough environment for women, with few female role models to look up to. She often faced skepticism from her male colleagues and clients, who doubted her ability to handle the demands of the job. However, Madhabi turned these challenges into opportunities to learn and grow. She developed a thick skin and focused on delivering results, earning the respect of her peers and superiors.

One of the key lessons Madhabi learned during this period was the importance of persistence and resilience. She realized that setbacks were inevitable, but how one responded to them was what truly mattered. This mindset helped her navigate the complexities of the financial world and prepared her for the leadership roles she would assume later in her career.

Building a Professional Foundation

Madhabi’s tenure at ICICI Bank laid the foundation for her illustrious career. she started working for ICICI in 1989 and quickly moved up the ranks, taking on roles with increasing responsibility. Her work in corporate banking gave her a deep understanding of the financial needs of businesses, while her involvement in strategic planning exposed her to the broader economic trends shaping the Indian market.

During her time at ICICI, Madhabi also developed a strong professional network, both within the bank and in the broader financial community. She built relationships with key industry players, including regulators, policymakers, and corporate leaders. These connections would prove invaluable in her later roles, particularly when she transitioned to regulatory and leadership positions.

She then moved to England where she worked as a Lecturer at West Cheshire College from 1993 to 1995. After working for various other companies for close to 12 years , in 2006 she joined ICICI securities and rose up the ranks to become its CEO in in 2009 till 2011. Then she joined Greater Pacific Capital , Singapore in 2011. For next 6 years she worked in various companies like Zensor Technologies , InnoVen Capital.

Achievements and Contributions to the Industry

Madhabi’s contributions to ICICI Bank and the broader financial industry were significant. She played a key role in expanding the bank’s global footprint, establishing operations in key international markets such as the United States, the United Kingdom, and the Middle East. Her strategic vision helped ICICI Bank become a leading player in the global banking sector, known for its innovative products and services.

Under Madhabi’s leadership, ICICI Bank also made significant strides in digital banking. She spearheaded initiatives to modernize the bank’s IT infrastructure, introduce online banking services, and leverage technology to improve customer experience. Her work in this area earned her recognition as a pioneer in digital finance, and she was often invited to speak at industry conferences on the subject.

Leadership Style and Management Philosophy

Madhabi Buch’s leadership style is a blend of strategic thinking, ethical conduct, and a strong focus on results. She believes in leading by example and is known for her hands-on approach to management. Whether it was in her early roles at ICICI Bank or later as SEBI Chairperson, Madhabi Buch has always been deeply involved in the decision-making process, ensuring that her teams are aligned with the organization’s goals.

Her management philosophy is centered around the principles of transparency, accountability, and collaboration. She encourages open communication within her teams and values diverse perspectives. Madhabi is also a strong advocate for ethical conduct in business, often emphasizing the importance of integrity and fairness in all dealings.

Building a Professional Network

Throughout her career, Madhabi Buch has built a robust professional network that spans across the financial industry, both in India and globally. Her connections with key industry players, regulators, and policymakers have been instrumental in her success. Madhabi’s ability to foster strong relationships has not only helped her in her corporate roles but also in her later position as SEBI Chairperson, where she had to navigate complex regulatory landscapes and engage with a wide range of stakeholders.

Transition to SEBI

Appointment as SEBI Chairperson

In March 2022, Madhabi Puri Buch was appointed as the Chairperson of the Securities and Exchange Board of India (SEBI), making history as the first woman to hold this prestigious position. Her appointment was widely celebrated in the industry, given her extensive experience and deep understanding of the financial markets. As SEBI Chairperson, Madhabi was tasked with overseeing the regulation and development of India’s securities market, a role that carries immense responsibility.

Buch was given full-time member status at SEBI in April 2017 and assigned responsibility for portfolios including investment management, surveillance, and collective investment schemes. Following the conclusion of her term, she was added to a seven-person technology committee that was established to assist SEBI in creating internal technical processes.

Buch, who is renowned for her data- and technology-neutral viewpoint, has issued a number of significant regulatory orders. She issued an order in 2018 directing the Sahara Group to repay the Rs. 14,000 crore that investors had contributed in the form of fully convertible debentures. This came about as a result of them disobeying a SEBI decision that required them to give investors the repayment data. Buch has out a thorough investigation on CNBC Awaaz journalist Hemant Ghai’s insider trading in January 2021 and prohibited him, his mother, and his wife from using the stock markets.

She issued an injunction in May 2021 against Savla and Ajitkumar for exchanging confidential, price-sensitive information about Deep Industries stock based on their social media interactions and connections. She discovered 15 companies engaging in dishonest trading practices in Zee Entertainment Enterprises stock following the company’s results reports in August 2021.

Buch was named SEBI’s chairwoman on March 1, 2022, and the position would be held for three years. She took Ajay Tyagi’s place. Buch joined SEBI during a difficult period and was questioned on the NSE co-location scheme by the parliamentary committee. Being a former member of the private sector, Buch made the decision to completely restructure SEBI in order to increase efficiency, strengthen accountability, and promote justice.

She has quickly changed the structure, procedures, and market regulations in her first 100 days as chairwoman. In order to encourage targeted action on areas that required attention, Buch established the corporate KRA system. She focused on using technology and data, as well as cyber security. She has spearheaded the process of getting broad market input on any significant policy modifications. Some claim that Buch has placed the onus on intermediaries to modify their systems in order for them to keep up with the fluctuations of the market.

The Indian stock market used a T+2 clearance procedure when she took charge. She encouraged clearing organizations and custodians to prepare for T+1 and T+0 clearance processes, which would expedite investors’ receipt of their funds and shares. The T+0 settlement mechanism was gradually implemented starting in 2024. Buch also requested more authority from the government to keep an eye on social media platforms in order to stop front-running in the markets.

Challenges and Opportunities in the Role

Taking on the role of SEBI Chairperson presented Madhabi Buch with both challenges and opportunities. The Indian securities market was at a critical juncture, with rapid technological advancements, increasing market participation, and evolving regulatory needs. Madhabi had to navigate these complexities while ensuring that the market remained fair, transparent, and resilient.

One of the key challenges Madhabi Buch faced was the need to balance market development with investor protection. As SEBI Chairperson, she was responsible for implementing regulations that fostered market growth while safeguarding the interests of retail investors. This required a delicate balancing act, as overly stringent regulations could stifle innovation, while lax regulations could lead to market abuses.

Key Initiatives and Reforms Implemented

Madhabi Buch’s tenure as SEBI Chairperson has been marked by several key initiatives and reforms aimed at enhancing market transparency, improving investor protection, controlling inflation (indirectly) and promoting sustainable growth. One of her first major initiatives was the introduction of stricter disclosure requirements for listed companies. This move was aimed at improving corporate governance and ensuring that investors had access to accurate and timely information.

Madhabi also focused on leveraging technology to enhance market surveillance and enforcement. Under her leadership, SEBI implemented advanced data analytics and artificial intelligence tools to monitor trading patterns, detect market manipulation, and enforce compliance. These technological advancements have significantly improved SEBI’s ability to maintain market integrity and protect investors.

Another key reform introduced by Madhabi was the enhancement of SEBI’s grievance redressal mechanism. She recognized the importance of addressing investor complaints promptly and effectively and implemented measures to streamline the process. This included the introduction of an online portal where investors could file complaints and track their status in real time.

Impact on the Indian Financial Market

Madhabi Puri Buch’s leadership has had a profound impact on the Indian financial market. Her initiatives to improve transparency, enhance investor protection, and leverage technology have strengthened the market’s resilience and boosted investor confidence. The reforms she introduced have also contributed to the market’s growth, attracting more domestic and foreign investors.

One of the most significant impacts of Madhabi’s tenure has been the increased participation of retail investors in the securities market. Her efforts to enhance investor education and protect retail investors have made the market more accessible and attractive to individual investors. This has led to a significant increase in market participation, which in turn has contributed to the market’s overall growth.

Handling Controversies and Criticisms

Like any high-profile leader, Madhabi Puri Buch has faced her share of controversies and criticisms during her tenure as SEBI Chairperson. Some market participants criticized her for being too strict in enforcing regulations, arguing that it stifled innovation and market growth. Others questioned the effectiveness of some of the reforms she introduced, particularly those related to corporate governance and disclosure requirements.

Madhabi has handled these criticisms with grace and resilience. She has always been open to feedback and has made adjustments to policies when necessary. However, she has also stood firm on her principles, particularly when it comes to investor protection and market integrity. Her ability to navigate controversies and maintain her focus on the broader goals of SEBI has earned her respect both within the organization and in the wider financial community.

Leadership and Management Style

Decision-Making Process

Madhabi Puri Buch’s decision-making process is characterized by a strong analytical approach combined with a deep understanding of the broader economic and regulatory environment. She believes in making informed decisions based on data and evidence and is known for her meticulous attention to detail. Whether it’s a strategic decision at the organizational level or a regulatory decision at SEBI, Madhabi ensures that all relevant factors are considered before arriving at a conclusion.

Madhabi is also a collaborative decision-maker. She values input from her team and other stakeholders and often involves them in the decision-making process. This not only ensures that decisions are well-rounded but also fosters a sense of ownership and accountability among her team members.

Team Building and Mentorship

One of Madhabi’s key strengths as a leader is her ability to build and nurture high-performing teams. She is known for her talent in identifying and cultivating potential in her team members and has mentored many professionals who have gone on to achieve significant success in their careers.

Madhabi’s approach to team building is centered around trust, empowerment, and continuous learning. She believes in giving her team members the autonomy to make decisions and encourages them to take on new challenges. At the same time, she provides the necessary support and guidance to ensure that they succeed. Her mentorship has been instrumental in shaping the careers of many professionals in the financial industry.

Vision and Strategic Thinking

Madhabi Puri Buch is a visionary leader with a clear strategic focus. Throughout her career, she has demonstrated a keen ability to anticipate industry trends and position her organizations to capitalize on them. Whether it was expanding ICICI Bank’s global footprint or driving technological innovation at SEBI, Madhabi has always been ahead of the curve.

Her strategic thinking is also evident in her approach to regulation at SEBI. She recognizes the need for a balanced regulatory framework that fosters innovation while ensuring market integrity. Her vision for the future of the Indian financial market is one that is transparent, resilient, and inclusive, with a strong emphasis on investor protection and sustainable growth.

Crisis Management Skills

Madhabi’s crisis management skills have been tested on several occasions throughout her career. Whether it was dealing with financial crises at ICICI Bank or handling market disruptions as SEBI Chairperson, Madhabi has consistently demonstrated the ability to navigate challenging situations with composure and effectiveness.

Her approach to crisis management is proactive and systematic. She believes in being prepared for potential crises by identifying risks early and developing contingency plans. When a crisis does occur, Madhabi’s focus is on swift and decisive action, while ensuring that all stakeholders are kept informed and that the long-term interests of the organization are protected.

Personal Life and Values

Family Life and Relationships

Despite her demanding career, Madhabi Buch has always prioritized her family. She is married to her college sweetheart, a fellow professional in the financial industry, and they have two children. Madhabi’s family has been her pillar of support throughout her career, providing her with the encouragement and stability needed to navigate the challenges of her professional life.

Madhabi is known to be a deeply private person, preferring to keep her personal life out of the public eye. However, those close to her describe her as a loving and devoted wife and mother, who values her family above all else.

Interests and Hobbies

In her limited free time, Madhabi enjoys reading, particularly on subjects related to economics, history, and philosophy. She is also an avid traveler, with a particular interest in exploring different cultures and understanding their economic and social systems. Her travels have provided her with valuable insights that have influenced her approach to leadership and regulation.

Madhabi is also passionate about fitness and wellness. She practices yoga regularly and believes in the importance of maintaining a healthy work-life balance. Her commitment to wellness extends to her professional life, where she encourages her team members to prioritize their well-being.

Philanthropic Activities

Madhabi Puri Buch is actively involved in philanthropic activities, particularly in the areas of education and women’s empowerment. She believes in giving back to society and has been associated with several charitable organizations over the years. Madhabi is particularly passionate about supporting initiatives that promote education for underprivileged children and empower women to achieve financial independence.

Her philanthropic activities are an extension of her core values of integrity, compassion, and social responsibility. Madhabi’s commitment to making a positive impact on society is evident not only in her professional achievements but also in her personal contributions to various social causes.

Core Values and Beliefs

Madhabi Puri Buch’s core values are integrity, transparency, and a commitment to excellence. These values have guided her throughout her career and are reflected in her leadership style and decision-making process. Madhabi believes in doing the right thing, even when it is difficult, and has always placed a strong emphasis on ethical conduct in all her professional dealings.

Madhabi is also a firm believer in the power of education and continuous learning. She attributes much of her success to the education and mentorship she received and is passionate about creating opportunities for others to learn and grow. Her belief in the importance of education is evident in her philanthropic activities and her efforts to mentor the next generation of leaders.

Legacy and Impact

Contributions to the Indian Economy

Madhabi Puri Buch’s contributions to the Indian economy are significant and far-reaching. Through her work at ICICI Bank and SEBI, she has played a key role in shaping the financial landscape of India. Her efforts to expand access to financial services, promote transparency, and protect investors have had a lasting impact on the Indian financial market.

Madhabi’s focus on innovation and technology has also contributed to the modernization of the Indian financial sector. Her initiatives to promote digital finance and enhance market surveillance have positioned India as a leader in fintech and financial regulation. Her legacy is one of innovation, integrity, and a relentless commitment to improving the financial system for all participants.

Role Model for Women in Leadership

As the first woman to lead SEBI, Madhabi Puri Buch is a trailblazer and a role model for women in leadership. Her achievements have inspired countless women to pursue careers in finance and aspire to leadership roles. Madhabi’s success is a testament to the fact that women can excel in even the most challenging and competitive industries.

Madhabi is also an advocate for gender diversity in the workplace. She has often spoken about the importance of creating opportunities for women and breaking down the barriers that prevent them from reaching their full potential. Her leadership has paved the way for greater representation of women in the financial industry, and her legacy will continue to inspire future generations of female leaders.

Impact on the Financial Industry

Madhabi Puri Buch’s impact on the financial industry extends beyond her roles at ICICI Bank and SEBI. Her work has influenced the way financial institutions operate, particularly in the areas of corporate governance, transparency, and investor protection. Her efforts to promote ethical conduct and responsible leadership have set new standards for the industry.

Madhabi’s focus on technology and innovation has also had a significant impact on the financial industry. Her initiatives to promote digital finance and leverage data analytics have transformed the way financial markets operate, making them more efficient, transparent, and resilient. Her legacy in the financial industry is one of leadership, innovation, and a commitment to integrity.

Future Aspirations and Goals

Looking ahead, Madhabi Puri Buch remains committed to her vision of a transparent, resilient, and inclusive financial market. While her tenure as SEBI Chairperson has been marked by significant achievements, she continues to work towards further strengthening the regulatory framework and ensuring that the Indian financial market remains competitive on the global stage.

Madhabi’s future aspirations include promoting sustainable finance and addressing the challenges posed by climate change to the financial system. She recognizes the need for the financial industry to play a leading role in addressing environmental and social challenges and is committed to driving initiatives that promote sustainability and responsible investing.

Madhabi Puri Buch’s journey is far from over, and her continued contributions to the financial industry will undoubtedly shape its future. As she looks to the future, Madhabi remains focused on her mission to create a fair, transparent, and resilient financial system that benefits all participants.

Controversies

A recent report by Hindenburg Research on Madhabi Buch ‘s investments and the resultant conflict of interest has created a nation wide controversy which has stirred up a political storm in the country and the Indian Parliament.

The Allegations

Investment in Offshore Funds: Hindenburg Research alleges that Madhabi Puri Buch and her husband held investments in offshore funds used by the Adani Group. Specifically, they invested in the Bermuda-based Global Opportunities Fund, which had sub-funds ( IPE Plus Fund 1 ) linked to Adani.

Conflict of Interest: This, Hindenburg argues, created a clear conflict of interest when SEBI was investigating allegations against the Adani Group.

Undisclosed Interests: Hindenburg Report raises questions about the transparency of Madhabi Buch’s financial interests, particularly her consulting firms, Agora Advisory Limited (India) and Agora Advisory Pte Ltd (Singapore). Hindenburg alleges that these companies might have undisclosed financial ties.

Leniency Towards Adani Group: The report suggests that SEBI’s actions, or lack thereof, in the Adani matter were influenced by the alleged conflict of interest, implying undue favoritism towards the conglomerate.

Investment Timeline:

2015-2018: Buch and her husband invested in IPE Plus Fund 1, a sub-fund of the Global Opportunities Fund.

2022: Buch transferred her stake in Agora Partners to her husband shortly after becoming SEBI chairperson.

Regulatory Implications:

Disclosure Norms: SEBI’s rules require full disclosure of financial interests by its officials. The report questions whether Buch adhered to these norms.

Recusal from Investigations: It is unclear whether Buch recused herself from investigations involving entities where she had a financial interest.

Political Reactions:

Opposition Demands: Opposition parties in India have called for a parliamentary probe and Buch’s resignation.

Government’s Stance: The government has stated that it has nothing further to add, leaving the matter in a state of limbo.

The Response:

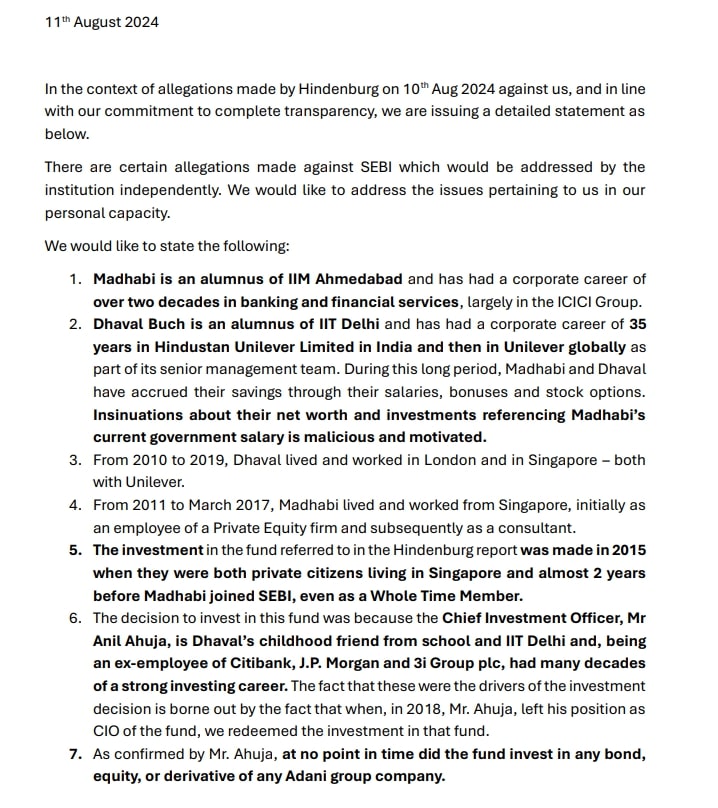

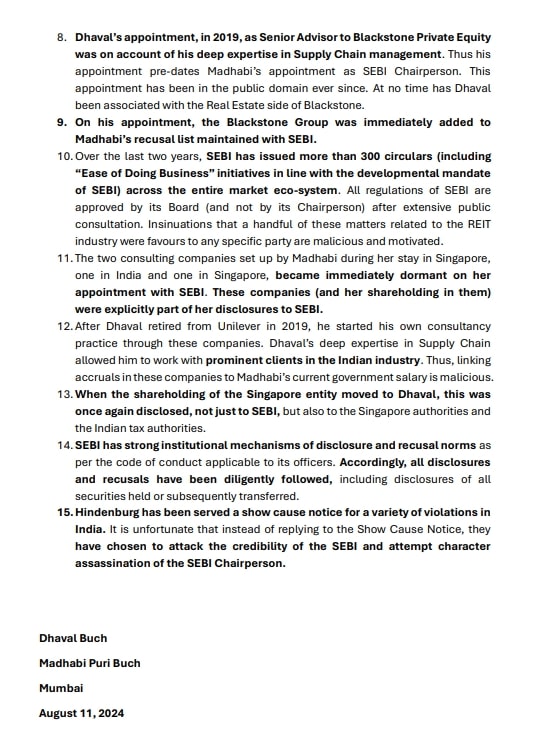

Madhabi Puri Buch and her husband, Dhaval Buch, vehemently denied the allegations, terming them “baseless” and “malicious.” SEBI also issued a statement asserting its independence and the robustness of its conflict of interest mechanisms. The regulator emphasized that it has strict protocols in place to address such situations, including mandatory disclosures and recusal provisions. The image of detailed statement issued by her husband Dhaval Buch on 11 August 2024 :

Conclusion

Notwithstanding the recent Hindenburg controversy , Madhabi Puri Buch’s journey from a young girl in Mumbai to the first woman to lead SEBI is a story of resilience, intellect, and unwavering commitment to integrity. Her leadership has had a profound impact on the Indian financial market, and her legacy will continue to inspire future generations. As she continues to shape the future of the financial industry, Madhabi Puri Buch remains a beacon of excellence, a role model for women in leadership, and a force to reckon with in the world of finance.

Frequently Asked Questions (FAQs)

1. What were Madhabi Puri Buch’s early influences in her career?

Madhabi Puri Buch was influenced by her professors at St. Stephen’s College and IIM-A, particularly Dr. Arvind Subramanian and Dr. Raghuram Rajan. Their teachings on economics, finance, and ethical conduct shaped her approach to leadership and decision-making.

2. How did Madhabi Puri Buch contribute to the digital transformation of ICICI Bank?

During her tenure at ICICI Bank, Madhabi spearheaded initiatives to modernize the bank’s IT infrastructure and introduce digital banking services. Her efforts helped ICICI Bank become a leader in digital finance and significantly improved customer experience.

3. What are some of the key reforms Madhabi Puri Buch introduced as SEBI Chairperson?

Madhabi introduced several key reforms at SEBI, including stricter disclosure requirements for listed companies, the use of advanced data analytics for market surveillance, and enhancements to the grievance redressal mechanism for investors.

4. How has Madhabi Puri Buch impacted the Indian financial market?

Madhabi’s leadership at SEBI has strengthened market transparency, improved investor protection, and promoted sustainable growth. Her initiatives have increased retail investor participation and attracted more domestic and foreign investment.

5. What are Madhabi Puri Buch’s future aspirations?

Madhabi is focused on promoting sustainable finance and addressing the challenges posed by climate change to the financial system. She is committed to driving initiatives that promote sustainability and responsible investing in the financial industry.

6. How does Madhabi Puri Buch’s leadership style influence her teams?

Madhabi’s leadership style is characterized by transparency, collaboration, and a strong focus on results. She empowers her team members, encourages open communication, and provides mentorship, fostering a high-performing and accountable work environment.

7. What role does Madhabi Puri Buch play in promoting gender diversity in the financial industry?

As a trailblazer and role model for women in leadership, Madhabi advocates for gender diversity in the workplace. Her achievements and advocacy have inspired more women to pursue careers in finance and aspire to leadership roles.

8. What are Madhabi Puri Buch’s core values?

Madhabi’s core values are integrity, transparency, and a commitment to excellence. These values guide her leadership style, decision-making process, and her approach to both her professional and personal life.

Reference : http://ptinews.com