Yang Huiyan, once hailed as the world’s youngest female billionaire, has faced a staggering setback as her wealth plunged by $25 billion over the past two years. The decline was propelled by the struggling fortunes of Country Garden, a property development company where Yang serves as the chairman. This dramatic reversal of fortune has shed light on the challenges plaguing China’s real estate sector, where declining profits and mounting debt have left even the most esteemed players grappling to stay afloat.

A Precarious Position

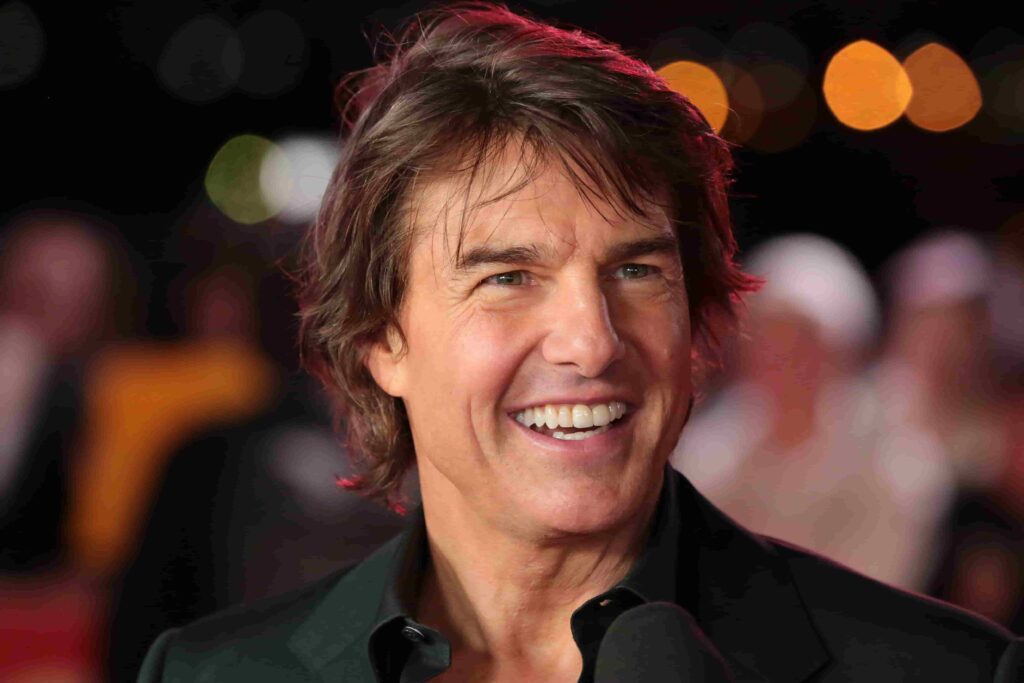

At 41 years old, Yang Huiyan’s journey from being crowned the world’s youngest female billionaire in 2007, at the age of 26, to witnessing her wealth diminish significantly is emblematic of the unpredictable nature of the real estate industry. Her substantial net worth of $4.6 billion still stands, but it marks a far cry from the zenith of $29.6 billion it reached in 2021. Yang’s wealth primarily stems from her 57% stake in Country Garden, a company that has encountered turbulence in recent times.

Country Garden’s Struggles

The challenges faced by Country Garden are manifold, as the company’s shares hit an all-time low due to declining profits and a mounting debt crisis. The property developer’s troubles have been exacerbated by missed interest payments of $22.5 million on two U.S. dollar bonds. While the company still has a grace period of 30 days to make the payments, preparations for a potential debt restructuring have already begun.

The situation has prompted a downgrade by Moody’s Investors Services, which cited deteriorating liquidity and escalating refinancing risks as reasons for the downgrade. Additionally, the company’s announcement of a potential net loss of up to $7.7 billion for the first half of 2023 has further exacerbated concerns.

The Importance of Funding Access

The uncertainty surrounding Country Garden’s ability to honor its debts underscores the critical nature of funding access in the real estate sector. As one of China’s largest property developers, Country Garden’s size and significance are undeniable. This systemic importance could prompt government and state-influenced banks to extend support, as stabilizing the real estate sector remains a priority amid economic recovery.

In the current climate, access to funding is paramount. Investors and analysts alike are closely watching how Country Garden navigates this challenge, as its actions could set a precedent for other struggling developers.

Navigating Uncertain Waters

Country Garden’s current predicament highlights the challenges faced by even the most reputed property developers in China. Once considered a stalwart in meeting debt obligations, Country Garden’s financial troubles have raised doubts about its ability to honor its commitments. A notable element of concern is the company’s $4.3 billion debt that is due in 2024, including bonds that investors can demand payment for.

With the value of some of the company’s offshore bonds plummeting to less than 10 cents on the dollar, it is evident that investors are anticipating an imminent default. The path forward is fraught with uncertainty, and survival hinges on securing government and state-influenced bank support.

The Family’s Role

Yang Huiyan, along with her sister Yang Ziying and husband Chen Chong, holds the responsibility of steering Country Garden through these turbulent waters. The company’s founder, Yang Huiyan’s father, built the business on offering residences outside major urban centers, a strategy that once set Country Garden apart. Now, the family faces the challenge of navigating a shifting landscape and evolving economic conditions.

A Glimmer of Hope

While the road ahead is undoubtedly challenging, optimists point to Country Garden’s systemic importance due to its size. Beijing’s potential inclination to stabilize the real estate sector amid economic recovery adds a glimmer of hope. Nevertheless, the company’s fate remains intertwined with the broader trajectory of China’s real estate market, which continues to grapple with deflation, economic shifts, and policy changes.

In a sector where unforeseen factors can dramatically reshape fortunes, Yang Huiyan’s journey underscores the delicate balance property developers must maintain to succeed in an evolving landscape. As the industry navigates uncharted waters, the resilience of developers like Country Garden is a testament to their enduring pursuit of adaptation and survival.