Hyperinflation is a severe and rapid form of inflation where prices rise uncontrollably in a short period, often leading to economic turmoil, social instability, and political crises. While regular inflation—characterized by a steady increase in prices—can be a sign of a healthy growing economy, hyperinflation represents a breakdown in the economic system, often with catastrophic consequences for countries and their citizens.

1. What Is Hyperinflation?

Hyperinflation is defined as a period of extremely high and typically accelerating inflation, usually exceeding 50% per month. While most economies experience inflation at manageable levels (often between 2% and 5% annually), hyperinflation is an extreme outlier. Prices in an economy experiencing hyperinflation can double in days or even hours.

Hyperinflation erodes the value of a country’s currency at such a rapid pace that money loses its function as a reliable medium of exchange or a store of value. This often forces citizens to resort to bartering goods and services or using foreign currencies for transactions. Savings evaporate overnight, and pensions or fixed incomes become worthless, pushing entire populations into poverty.

2. Causes of Hyperinflation

Hyperinflation is not caused by a single factor but rather a combination of underlying economic problems that compound each other. The most common causes of hyperinflation can be categorized as follows:

2.1 Demand-Pull Inflation

Demand-pull inflation occurs when demand in an economy far outweighs the supply. In such cases, businesses raise prices because consumers are willing to pay more for goods and services. This is relatively normal in growing economies but becomes dangerous when driven by excessive monetary expansion or significant shifts in consumer behavior.

In hyperinflation scenarios, governments may print excessive amounts of money to finance war efforts, pay off national debt, or cover budget deficits. As more money chases the same amount of goods, prices skyrocket.

2.2 Cost-Push Inflation

Cost-push inflation occurs when the cost of producing goods and services increases significantly. This could be caused by a variety of factors, such as rising wages, increased costs of raw materials, or a sudden shortage in essential commodities. Businesses then pass on these higher costs to consumers in the form of higher prices.

When cost-push inflation occurs alongside a supply shock (such as an oil crisis or widespread crop failure), inflation can accelerate rapidly, contributing to a hyperinflationary spiral.

2.3 Money Supply Mismanagement

One of the most critical causes of hyperinflation is the uncontrolled expansion of a country’s money supply. In many cases, governments will print more money in an attempt to pay off debts or finance public spending without corresponding growth in the economy’s productive capacity.

As the supply of money increases disproportionately to the supply of goods and services, the purchasing power of the currency declines sharply. The resulting loss of confidence in the currency can lead to a vicious cycle of ever-increasing prices and panic buying, further exacerbating hyperinflation.

3. Historical Examples of Hyperinflation

Several countries have experienced hyperinflation throughout history, and these case studies serve as valuable lessons on the dangers of mismanaging an economy. The most striking examples of hyperinflation are :

3.1 Weimar Germany (1921-1923)

One of the most famous examples of hyperinflation occurred in post-World War I Germany. The Weimar government, burdened by reparations payments under the Treaty of Versailles, began printing money to cover its debts. As the money supply increased dramatically, the German mark’s value plummeted, and by 1923, inflation had reached astronomical levels.

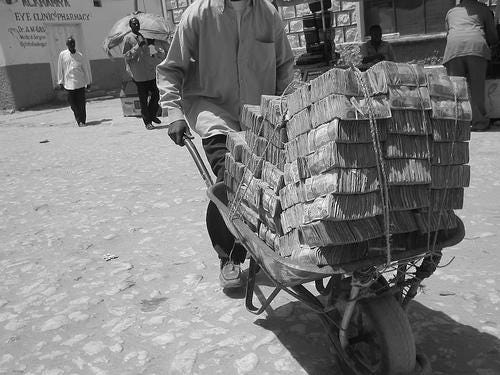

At its peak, prices were doubling every few days, and people resorted to carrying wheelbarrows full of banknotes to purchase basic necessities. The economic crisis led to widespread social unrest and political instability, contributing to the eventual rise of Adolf Hitler.

3.2 Zimbabwe (2007-2008)

Zimbabwe experienced one of the most extreme cases of hyperinflation in recent history. Following years of economic mismanagement, political corruption, and land reform policies that devastated agricultural output, Zimbabwe’s inflation rate began to skyrocket in the early 2000s.

By November 2008, inflation in Zimbabwe had reached an estimated 79.6 billion percent month-over-month. Prices were doubling every 24 hours, and the Zimbabwean dollar became effectively worthless. The government eventually abandoned its currency and adopted the US dollar and other foreign currencies to stabilize the economy.

3.3 Venezuela (2016-2020)

Venezuela’s hyperinflation crisis began in the mid-2010s, spurred by a collapse in oil prices, which was the country’s main source of revenue. Years of economic mismanagement, including price controls, currency devaluations, and excessive government spending, exacerbated the situation.

By 2018, inflation in Venezuela reached over 1,000,000%, and the government was forced to issue new banknotes repeatedly to keep up with rising prices. The crisis led to severe food and medicine shortages, widespread poverty, and a mass exodus of Venezuelans seeking refuge in neighboring countries.

4. Effects of Hyperinflation

Hyperinflation has far-reaching consequences that affect not only a country’s economy but also its social and political fabric. The effects of hyperinflation can be categorized into three main areas:

4.1 Economic Impacts

Loss of Savings: Hyperinflation erodes the value of money so quickly that people’s savings become worthless almost overnight. This discourages saving and investment, undermining long-term economic growth.

Collapse of Financial Institutions: Banks and financial institutions that rely on currency stability are heavily impacted, often leading to the collapse of the banking sector.

Barter Systems: As the currency loses its value, people may revert to barter systems, exchanging goods and services directly instead of using money.

Capital Flight: Wealthy individuals and businesses often move their assets abroad in search of stable currencies and safer investment environments, exacerbating the economic crisis.

4.2 Social Impacts

Increased Poverty: Hyperinflation devastates the poor and middle class, who may not have access to foreign currency or inflation-proof assets. The loss of purchasing power leads to widespread poverty, hunger, and homelessness.

Social Unrest: As people struggle to afford basic goods and services, tensions rise, leading to protests, strikes, and sometimes violent uprisings.

Mass Emigration: Citizens may flee their country in search of better living conditions, causing a brain drain and labor shortages in the affected nation.

4.3 Political Consequences

Loss of Confidence in Government: Hyperinflation erodes trust in the government and its ability to manage the economy, leading to political instability.

Rise of Extremist Movements: Economic crises often provide fertile ground for the rise of extremist political parties and leaders who promise quick fixes or scapegoat certain groups for the crisis.

Potential Regime Change: In extreme cases, hyperinflation can lead to the downfall of governments, as seen in Weimar Germany and Zimbabwe.

5. How Countries Respond to Hyperinflation

Hyperinflation requires decisive action to stabilize the economy and restore confidence in the currency. Counties’ most commonly responses include:

5.1 Monetary Policy

Governments may implement tighter monetary policies to reduce the money supply and curb inflation. Central banks can increase interest rates and reduce the amount of money in circulation to stabilize the economy. However, this approach is often challenging in hyperinflationary environments because confidence in the currency may already be irreparably damaged.

5.2 Currency Reform

In many cases, governments are forced to introduce new currencies to replace the devalued old currency. For instance, after its hyperinflation crisis, Zimbabwe abandoned the Zimbabwean dollar and adopted the US dollar and other foreign currencies. In Germany, the Rentenmark replaced the hyperinflated Papiermark in 1923, helping to stabilize the economy.

5.3 Foreign Aid and Loans

Countries experiencing hyperinflation may seek help from international organizations such as the International Monetary Fund (IMF) or foreign governments. Loans and foreign aid can provide much-needed liquidity and resources to stabilize the economy, but these solutions often come with strict conditions for economic reform.

6. Preventing Hyperinflation

Preventing hyperinflation requires sound economic policies and strong institutional frameworks. Key strategies include:

Maintaining Fiscal Discipline: Governments must avoid excessive borrowing and printing of money to cover budget deficits.

Stable Monetary Policies: Central banks should prioritize keeping inflation within manageable limits, typically through interest rate adjustments and controlling the money supply.

Diversifying the Economy: Countries overly reliant on a single commodity or industry are more vulnerable to external shocks that can trigger inflation. Diversifying economic activities can help mitigate this risk.

Building Trust in Institutions: Citizens must trust their government and financial institutions to manage the economy effectively. Strong, transparent institutions can prevent the panic that often exacerbates hyperinflation.

7. Conclusion

Hyperinflation is a devastating economic phenomenon that can destroy economies, undermine governments, and cause immense suffering for citizens. While it is rare, hyperinflation typically occurs when there is a combination of poor monetary policy, political instability, and external shocks.

The lessons from historical examples like Weimar Germany, Zimbabwe, and Venezuela highlight the importance of sound economic management and strong institutions. While hyperinflation can be difficult to predict and even harder to reverse, countries that adhere to prudent fiscal and monetary policies are less likely to face its devastating consequences.

8. Frequently Asked Questions (FAQs)

Q1: How is hyperinflation different from regular inflation?

Hyperinflation is an extreme form of inflation where prices increase at an incredibly fast rate, often more than 50% per month. In contrast, regular inflation is typically a gradual and manageable increase in prices, usually ranging from 2% to 5% annually.

Q2: What are the main causes of hyperinflation?

The main causes of hyperinflation include an excessive increase in the money supply, demand-pull inflation (where demand outstrips supply), and cost-push inflation (where the cost of goods and services rises dramatically).

Q3: Can hyperinflation be predicted?

While hyperinflation is difficult to predict with precision, warning signs include uncontrolled money printing, high national debt, political instability, and major economic disruptions such as wars or natural disasters.

Q4: How do people survive during hyperinflation?

During hyperinflation, people may resort to bartering, using foreign currencies, or investing in tangible assets like real estate or gold that hold their value better than local currency.

Q5: Can hyperinflation happen in developed countries?

While hyperinflation is more common in developing countries with weaker institutions, it is theoretically possible in developed countries if there is severe economic mismanagement or a catastrophic event that undermines the currency’s value.

Q6: How can hyperinflation be stopped?

Hyperinflation can be stopped through monetary reforms, such as issuing a new currency, reducing the money supply, or receiving foreign aid. However, restoring trust in the economy can take significant time and effort.

Reference : http://www.fools.com