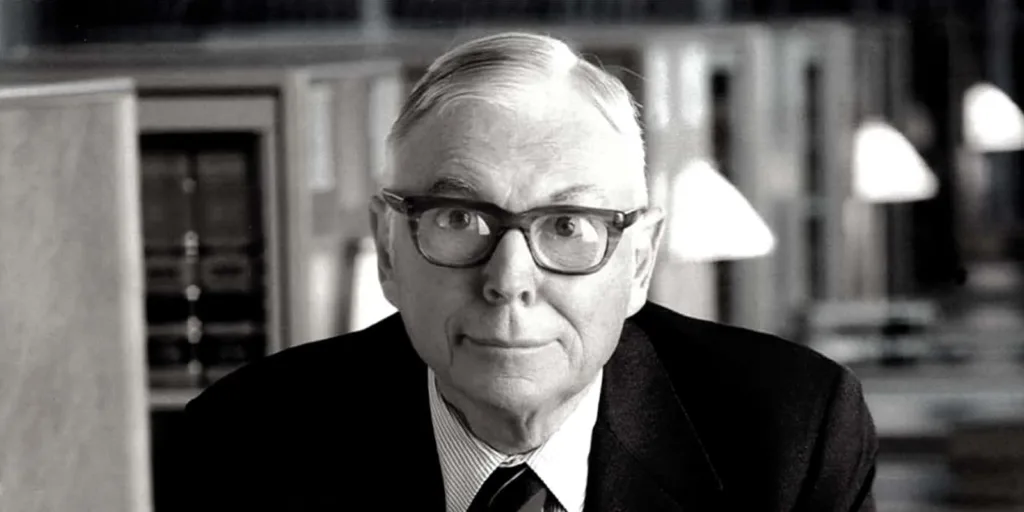

Charlie Munger, the renowned vice chairman of Berkshire Hathaway and a Warren Buffett’ s man friday, departed this life on November 28, 2023, at the age of 99. Warren has mentioned many a times that Munger made Berkshire Hathaway what it is today. Munger left a lasting impression on the finance world with his towering stature, keen wit, and deep understanding in value investing. His life served as an example of the transforming power of brilliance, hard work, and humility.

Early Life

Charles Thomas Munger was brought up in a humble ,middleclass household by a housewife mother Florence “Toody” (Russel) and Alfred Case Munger ,a lawyer father. Born in Omaha, Nebraska, on January 1, 1924 Munger possessed a sharp intellect and exhibited an inquisitive mind as a youngster who excelled at school and showed a keen interest in the world. Some relationships are destined to be, as is evident from the fact that charlie worked as a youngster at Buffett & Son, Warren Buffett’s grandfather’s grocery store where he never ran into Warren ,who he was destined to forge an enduring relationship with , decades later

His father, Alfred Case Munger, fondly called Al was a lawyer who also went to Harvard Law School. His grandfather was Thomas Charles Munger who had struggled hard in life to rise to be a U.S. district court judge and state congressman. Charlie studied mathematics at the University of Michigan. He was a member of the fraternity Sigma Phi Society throughout his college years . He dropped out of college in early 1943, only a few days after his 19th birthday, to join the United States Army Air Corps, where he advanced to the rank of second lieutenant. Following a good score on the Army General Classification Test, he was sent to study meteorology at Caltech in Pasadena, California.

Education

Charlie Munger’s educational journey was marked by intellectual curiosity, a thirst for knowledge, and a willingness to explore diverse disciplines. His early education began in Omaha, Nebraska, where he attended public schools and demonstrated a keen aptitude for academics. In 1940, at the age of 16, he enrolled at the University of Michigan to study mathematics, but his academic pursuits were interrupted by World War II. He enlisted in the Army Air Corps and served as a meteorologist, gaining valuable insights into mathematics, physics, and meteorology.

After the war, Munger resumed his education at Caltech, where he delved into the world of physics and engineering. While his passion for science remained strong, he discovered a growing fascination with law and its intersection with society. This newfound interest led him to Harvard Law School, where he graduated magna cum laude in 1948. At Harvard, Munger was deeply influenced by the teachings of renowned legal scholar Lon Fuller, whose emphasis on multidisciplinary thinking and the importance of understanding diverse perspectives resonated deeply with him.

Munger’s educational journey extended beyond formal institutions. He was an avid reader, devouring books on philosophy, psychology, history, and diverse fields of knowledge. He believed in lifelong learning, constantly seeking new insights and expanding his intellectual horizons. His voracious appetite for knowledge and his willingness to explore different disciplines laid the foundation for his multifaceted understanding of the world and his success in various fields, including law, business, and investing.

Life’s Struggles

The Great Depression coincided with early years of Munger’s life and helped shape his strong attitude in life. Growing up in a financially troubled household, he acquired a practical approach to life’s issues. This early struggle would subsequently lead to the creation of his distinct financial strategy.

Charlie Munger’s life was not without its share of challenges. He faced financial difficulties in his early years, working at odd jobs to supplement his family’s income while attending school. Academically, he struggled with dyslexia, which made reading and writing difficult. However, he persisted, overcoming these obstacles to achieve academic success and eventually earn a law degree from Harvard Law School.

Munger’s early investment career was also marked by setbacks. His first investment partnership, Munger Investment Partnership, experienced significant losses in the early 1970s. This setback could have discouraged Munger, but he instead took it as a learning experience, refining his investment philosophy and emerging as a stronger investor.

Munger had his left eye removed owing to significant agony in his 50s after a botched ocular cataract operation leaving his left eye blind. Munger began learning braille when physicians informed him that he had developed a disease that might cause his remaining eye to become inflamed, a condition known as sympathetic ophthalmia, which could have left him completely blind. The eye issue gradually resolved itself, and he retained vision in his right eye for the remainder of his life.

Despite these challenges, Munger’s resilience and determination shone through. He never wavered in his belief in value investing principles and continued to seek out undervalued companies. His unwavering focus on long-term fundamentals, coupled with his sharp intellect and business acumen, ultimately led to his remarkable investment success.

A Devoted Family Man

While Munger is renowned for his financial acumen, his personal life is characterized by a strong commitment to family. Charlie Munger’s married life was marked by two enduring relationships, each contributing significantly to his personal and professional journey. His first marriage to Nancy Huggins began in 1945, while he was studying at the California Institute of Technology (Caltech). Together, they had three children, including their son Barry, who tragically passed away from cancer at the age of nine. Despite this heartbreaking loss, the couple remained steadfast in their commitment to each other, sharing a life filled with love, support, and intellectual companionship. Nancy’s untimely passing in 1953 left Munger deeply saddened, but he eventually found solace and love again.

In 1956, Munger met Nancy Barry, his future wife, on a blind date. Their connection was immediate, and they married soon after. Nancy, a woman of remarkable intelligence and wit, became Munger’s lifelong companion and confidante. Their partnership was marked by mutual respect, shared interests, and a deep understanding of each other’s personalities. They shared a love for reading, travel, and intellectual pursuits, often engaging in stimulating discussions about philosophy, history, and current events. Together, they raised four children, building a strong and loving family unit. Nancy remained a steadfast pillar of support for Munger throughout his illustrious career, providing him with unwavering encouragement and sage counsel. Their marriage, spanning over four decades, was a testament to their unwavering love, mutual admiration, and shared commitment to personal growth and intellectual exploration

Charlie Munger’s Daily Routine

Munger’s mornings were typically early, starting at 6:00 AM when he woke up and ate a light breakfast. After breakfast, he would dedicate time to reading, immersing himself in a variety of books and articles spanning diverse disciplines. He would often read for several hours, seeking out information on philosophy, history, psychology, and science. His voracious appetite for knowledge fueled his understanding of the world and contributed to his profound insights.

Around 10:00 AM, Munger would begin his workday. As Vice Chairman of Berkshire Hathaway, he would engage in discussions with colleagues, analyze financial data, and make informed investment decisions. His approach to investing was deeply rooted in his understanding of human behavior, economics, and the intricacies of the business world.

In the afternoons, Munger would often continue his professional endeavors, working until around 5:00 PM. However, he would also make time for intellectual pursuits beyond his professional realm. He enjoyed engaging in stimulating conversations with friends and colleagues, exploring new ideas, and challenging conventional wisdom. His intellectual curiosity was boundless, and he relished the opportunity to expand his horizons and learn from others.

Evenings were typically spent relaxing and enjoying the company of his family. He would have dinner with his wife and children, often discussing the day’s events and engaging in lively conversations. He cherished his relationships with his loved ones and valued the opportunity to connect with them on a deeper level. His commitment to personal growth extended beyond the realm of knowledge and included cultivating strong relationships and fostering a sense of well-being.

Munger’s daily routine was a testament to his dedication to lifelong learning, intellectual exploration, and personal growth. His unwavering pursuit of knowledge, coupled with his commitment to ethical behavior and sound judgment, made him a true titan of the investment world and a respected figure in society.

Career

Munger established Munger Investment Partnership, a tremendously profitable hedge fund, in 1959. His successful business was founded on the value investing theory, which emphasizes buying stocks at a discount to their intrinsic value.

Munger, a well-known financier, relocated his family to California and joined the legal firm Wright & Garrett. Later, he worked as a real estate attorney at Munger, Tolles & Olson LLP before transitioning into investment management. He cofounded established Wheeler, Munger, and Company, an investing business listed on the Pacific Coast Stock Exchange. Munger closed Wheeler, Munger, and Co. in 1976 after suffering 32% losses in 1973 and 31% losses in 1974.

Munger also co-managed an investing partnership with Buffett from 1962 to 1975, which achieved compound annual returns of 19.8% compared to the Dow’s yearly growth rate of 5.0%. He was previously the chairman of Wesco Financial Corporation, which is now a completely owned subsidiary of Berkshire Hathaway. The acquisition of Wesco was contentious due to allegations that Buffett’s business, Blue Chip, purchased Wesco stock to prevent a merger between Wesco and Financial Corp. Wesco Financial had a concentrated equity portfolio worth more than US$1.5 billion, which included Coca-Cola, Wells Fargo, Procter & Gamble, Kraft Foods, US Bancorp, and Goldman Sachs.

Munger’s annual shareholders’ meeting, held in Pasadena, California, was nearly as legendary in the investment community as those he co-hosted with Buffett in Omaha. Munger interacted with other Wesco shareholders at considerable length, sometimes speculating about Benjamin Franklin’s response in such situations

Charlie Munger Meets Warren Buffet

Charlie Munger and Warren Buffett, two of the most influential figures in the world of investing, met for the first time in their shared hometown of Omaha, Nebraska, in 1959. Their paths had never crossed despite being lifelong residents of Omaha and working at the same grocery store as teenagers. The introduction was orchestrated by mutual friend and investor Walter Scott Jr., who recognized the potential synergy between the two men.

Their first meeting took place at a dinner party hosted by Scott in October 1959. The gathering was a lively affair, filled with stimulating conversations and intellectual banter. As the evening progressed, Munger and Buffett found themselves drawn to each other’s company, engaging in a deep discussion about investing philosophy, risk management, and the importance of value investing principles.

Their shared passion for value investing and their mutual respect for each other’s intellect sparked an instant connection. Munger, a lawyer by training, brought a breadth of knowledge and experience to the table, complementing Buffett’s financial expertise. Their complementary backgrounds and perspectives proved to be a powerful combination, laying the foundation for a decades-long partnership that would transform Berkshire Hathaway into one of the most successful investment companies in history.

Warren Buffett and Munger had their crucial meeting in 1963.The two forged a close personal and collaborative relationship, they became close because of their mutual appreciation for Benjamin Graham’s value investing beliefs.

After joining the board at Berkshire Hathaway in 1978, Munger had a significant impact on the company. Buffett’s investments in Coca-Cola, Wells Fargo, and American Express have been successful in large part because of his value investing expertise.

Munger’s Most Notable Investments

A dedication to value investing, which places an emphasis on long-term fundamentals over cyclical market swings, was the cornerstone of Munger’s investment philosophy. Among the notable investments are:

Berkshire Hathaway: Munger had a significant impact on the company’s strategy ever since he joined in 1978 , which helped it invest in profitable companies including Coca-Cola, American Express, and Wells Fargo.

BYD Company: Munger’s initial investment in the Chinese manufacturer BYD demonstrated his faith in the company’s leadership and technological prowess, foreseeing its ascent to prominence in the global auto sector.

Coca-Cola (KO): Munger believes strongly in the power of brands and has long supported Coca-Cola. Berkshire Hathaway invested in Coca-Cola for the first time in 1988, and it is now one of the company’s major holdings.

Daily Journal Corporation (DJCO) : Munger is the chairman of the board of Daily Journal Corporation (DJCO), a newspaper publisher. He has been a long-time admirer of the firm and feels it has a promising future.

Costco Wholesale: Munger was a strong advocate for the company’s low-cost, high-volume business model, and as a result, Berkshire Hathaway is currently the second-largest shareholder.

Some Lessons Along The Way

Failures were unavoidable for Munger ,one such instance is the insurance company Wesco Financial Corporation, which he created in 1984. Munger stuck to value investing concepts even though the fund underperformed. He modified his strategy after experiencing setbacks and carried on making profitable investments. Munger’s interests extended beyond finance. He was an avid reader and lifelong learner. He actively supported initiatives in healthcare and education as a devout spouse, parent, and philanthropist.

The Sage of Omaha’s Reflections

Munger reflects on life and achievement in public appearances and publications. He promotes the development of a wide mental framework and encourages people to embrace interdisciplinary thinking. According to Munger, success necessitates a complex awareness of the world, the ability to synthesize information, and a dedication to constant learning.

Chalie ‘s Networth

Charlie Munger, the famed investor and Berkshire Hathaway vice chairman, was a man of extraordinary fortune, with an estimated net worth of $2.6 billion at the time of his death in 2023. His fortune was built mostly on long-term investments in Berkshire Hathaway shares and other profitable firms.

Berkshire Hathaway Inc.

Munger’s most valuable asset was his investment in Berkshire Hathaway, the firm he co-founded with Warren Buffett to turn into a global powerhouse. Munger has around 4,000 shares of Berkshire Hathaway Class A stock worth more than $2 billion as of 2023.

Investing in Real Estate

Munger has a real estate portfolio in addition to his considerable stakes in Berkshire Hathaway. He was a savvy real estate investor who recognised the potential for long-term value appreciation. His real estate interests comprised homes, commercial structures, and farms.

Other Investments

Munger’s investing portfolio included companies other than Berkshire Hathaway and real estate. He also had stock in many other corporations, including Wells Fargo, Coca-Cola, and BYD Company. His value investing concept influenced his investment selections, emphasising the finding of undervalued firms with excellent fundamentals.

Personal Property

Munger’s personal assets included his principal property in Los Angeles, California, a collection of art and antiques, and a library full of books on a variety of topics. He was a simple man who was not motivated by excessive goods or flashy shows of riches.

Charlie Munger As Philanthropist

Charlie Munger, a renowned investor and vice chairman of Berkshire Hathaway, was a generous philanthropist who believed in the transformative power of education, healthcare, and cultural enrichment to improve society. He supported institutions like the University of California, Santa Barbara, the University of Michigan, and the Marlborough School in Los Angeles, enabling them to expand their facilities, enhance their academic programs, and provide scholarships to deserving students. Munger also extended his philanthropic reach to the Good Samaritan Hospital in Los Angeles, supporting its efforts to provide quality medical care to the underserved.

His generosity helped the hospital expand its facilities, acquire advanced medical equipment, and attract top-notch medical professionals. Munger also recognized the importance of cultural enrichment and the arts in fostering a vibrant and intellectually stimulating society. He supported the Huntington Library and Art Museum in San Marino, California, preserving and showcasing its vast collection of rare books, manuscripts, and artworks. Munger’s philanthropic endeavors extended beyond monetary contributions, serving on boards of directors and providing valuable guidance to various organizations.

Books, Lectures And Articles By Charlie Munger

Charlie Munger was a prolific writer and speaker who shared his knowledge and insights in a variety of books, essays, and speeches. His books are a goldmine of excellent insights on investment, life, and decision-making.

“Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger”

Peter D. Kaufman’s complete collection of Munger’s publications provides a deep dive into his investing philosophy, life experiences, and conceptual framework. It contains transcripts of Munger’s lectures, writings, and correspondence, giving readers a rich tapestry of his ideas and opinions.

“A Lesson on Elementary, Worldly Wisdom as it Relates to Investment Management & Business”

Munger’s groundbreaking paper, presented at the USC Law School Securities Regulation Institute in 1994, is regarded as a classic on financial insight. It incorporates Munger’s basic value investing beliefs, emphasizing the relevance of psychological biases, decision-making frameworks, and long-term value pursuit.

“The Psychology of Human Misjudgment”

Munger delves into the human mind’s proclivity for erroneous judgement in this interesting article. He goes into psychological biases including overconfidence, confirmation bias, and the availability heuristic, offering useful insights into how these biases might impact our judgements, especially financial decisions.

“The Investor’s Checklist”

Taking inspiration from Ben Graham’s famous work, “The Intelligent Investor,” Munger created his own checklist of elements to examine while making investing decisions. This checklist emphasises the significance of knowing a company’s underlying worth, competitive advantages, and the integrity of its management.

“Charlie Munger: 20 Book Recommendations That Will Make You Smarter”

Munger was an avid reader and ardent supporter of lifelong learning. He produced a list of 20 books he deemed necessary for developing critical thinking abilities, understanding human behaviour, and making sound judgements.

Munger’s publications continue to inspire and educate investors and people all over the world. His insights on human psychology, decision-making, and value investment give timeless advice that can be applied to a wide range of situations.

Successful Investors Who Learnt From Charlie

Charlie Munger, the famed investor and Berkshire Hathaway vice chairman, was a respected mentor to many budding investors. His knowledge and ideas on value investing, psychology, and decision-making have affected the careers of many successful people in the financial world. Here are some of the most well-known investors who have been profoundly inspired by Munger’s teachings:

Mohnish Pabrai: Munger’s most well-known protégé, is a successful value investor and author of “The Dhandho Investor: The Rules for Value Investing.” Pabrai credits Munger for teaching him the fundamentals of value investing as well as the significance of psychological biases in investment decisions.

Gurley, Bill: a notable venture investor and author of “Cracking the Enigma: The Secret to More Inspired Investment Decisions,” has been profoundly affected by Munger’s contrarian investment strategy and emphasis on determining a company’s underlying worth.

Howard Marks: Oaktree Capital Management co-founder and co-chairman Howard Marks has lauded Munger’s ability to distil complicated concepts into basic and workable principles. Munger’s theories have been integrated into Marks’ investment philosophy and risk management technique.

James Montier: an internationally known investment strategist and author of “The Art of Unreasonable Thinking,” has been affected by Munger’s emphasis on understanding human behaviour and the significance of psychological biases in financial decisions.

Li Lu: a well-known hedge fund manager and author of “Lu’s Investment Lessons: From the Great Depression to the Global Financial Crisis,” has stated that Munger taught him the value of patience, discipline, and independent thinking in the business sector.

These are just a handful of the numerous investors influenced by Charlie Munger’s knowledge and observations. Beyond his personal financial success, he has motivated other people to follow value investing ideas and get a better grasp of human psychology and decision-making.

Charlie Munger And Becky Quick

Charlie Munger and Becky Quick have a long history of interactions, with Munger appearing on CNBC’s “Squawk Box” and “Closing Bell” numerous times over the years. However, it’s important to note that not every interaction between Munger and Quick was a formal interview.

In recent years, Munger has granted two particularly noteworthy interviews to Quick:

Charlie Munger: A Life of Wit and Wisdom (2023):

This special interview aired on CNBC on November 30, 2023, to commemorate Munger’s soon-to-come 100th birthday. The interview featured Munger reflecting on his life, career, and investment philosophy.

You’ve got to learn how to recognize rare opportunities (2023):

This interview was conducted on November 14, 2023, and featured Munger discussing a wide range of topics, including his life, career, and investing philosophy. Munger also shared his thoughts on the current state of the market and the importance of recognizing rare opportunities. This was Charlie Munger’s final CNBC interview.

In addition to these formal interviews, Munger has also made numerous appearances on CNBC’s “Squawk Box” and “Closing Bell” to provide commentary on various topics. These appearances have often been impromptu and have given viewers insights into Munger’s thinking on a variety of issues.

Overall, Charlie Munger and Becky Quick have a strong rapport, and their interactions have provided valuable insights for investors and viewers alike.

Some Lesser Known Facts About Charlie Munger

Interest in Meteorology: During WWII, Munger served in the United States Army Air Corps, where he acquired a deep interest in meteorology. Before studying law and finance, he considered a career in the sector.

Music and Literature Lover: Munger was a huge music fan, especially classical and opera. He also had a strong interest for reading, absorbing volumes ranging from philosophy to history.

Bridge and Chess Player: He was an accomplished bridge player as well as a committed chess player, enjoying the intellectual challenge and strategic thinking involved in both games.

Unconventional Teacher : Munger’s teaching style was as distinct as his personality. He frequently used unique approaches to explain complicated financial topics, such as analogies and humour.

Exceptional Teacher and Mentor: Munger was a dedicated teacher, sharing his wisdom and insights with students and aspiring investors alike. He mentored countless individuals, imparting his value investing principles and life lessons.

Philanthropist: Munger’s generosity extended beyond the financial realm. He was a passionate philanthropist, supporting various causes, including education, healthcare, and conservation.

Lifelong Learner: Munger remained an avid learner throughout his life, constantly seeking new knowledge and perspectives. He embraced diverse subjects, from science and technology to psychology and philosophy.

Witty and Humorous: Munger’s sharp wit and sense of humor were legendary. He was known for his quotable quips and insightful observations, often infused with a touch of self-deprecating humor.

Humble and Self-Aware: Despite his immense success, Munger remained humble and self-aware. He never lost sight of the importance of learning from mistakes and adapting to changing market conditions.

Legacy

Munger left behind a legacy that goes beyond his financial achievements. He was a smart and perceptive mentor whose lessons on life and value investing have inspired and guided generations of investors all over the world.

Charlie Munger has surely lived a life worth emulating. There is so much one can learn from Charlie not just about investments but about how to live a materially successful and life of abundance without giving up on your ethics and integrity. His philanthropic efforts point to the spiritual side of him. He donated extensively to health sector , education and arts to make live better. May his noble soul rest in peace. And may us all learn from his life the way to live and strike a balance between materialism and spiritualism.

Reference : http://www.cnbc.com