Mohnish Pabrai is an Indian-American entrepreneur, investor, and philanthropist, who was born in Mumbai in 1964.Pabrai did his early schooling in India studying in various schools .He showed signs of academic excellence in early life and he was particularly good at Mathematics and Science. He then moved abroad for higher studies. He went on to become a successful investor emulating the investment philosophy of the financial wizards like Warren Buffet and Charlie Munger. It was only by chance that he stumbled upon the value investing principles of Benjamin Graham.

Education

Mohnish Pabrai’s educational background showcases a strong foundation in technical and business disciplines, coupled with a continuous pursuit of knowledge.

Pabrai’s academic journey also included formative experiences at various schools in India. He attended Jamnabai Narsee School (4th-5th Grade), Maneckji Cooper Education Trust School (5th-8th Grade), The Air Force School (8th-10th Grade) New Delhi , and The Indian High School (11th-12th Grade ) Dubai. These diverse educational environments likely played a role in shaping his worldview and fostering his intellectual curiosity.

He holds a Bachelor of Science in Computer Engineering from Clemson University (1983-1986), demonstrating his early aptitude for technology. Following his undergraduate studies, he embarked on a lifelong learning journey, attending the YPO Harvard President’s Seminar for nine years (1999-2011), culminating in his recognition as an alumnus of Harvard Business School. This commitment to continuous learning reflects his dedication to personal and professional development.

Overall, Mohnish Pabrai’s educational background highlights his commitment to intellectual growth, encompassing both formal academic qualifications and ongoing learning initiatives. This dedication to continuous self-improvement has undoubtedly contributed to his success as a prominent figure in the investment world.

Family

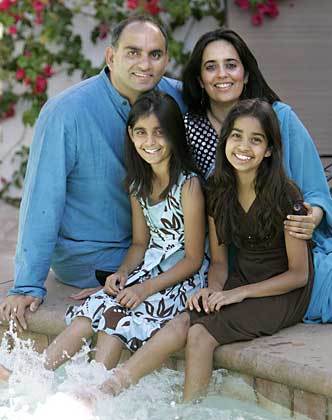

In 1992, he married Harina Kapoor, with whom he had two daughters, Monsoon and Momachi. Pabrai and Harina divorced in 2019.

Mohnish Pabrai’s two daughters, Hapoor and Parabai, have two children, Monsoon and Momachi.

Monsoon Pabrai is a 28-year-old Managing Partner of Drew Investment Fund who graduated from UC Berkeley. She formerly worked as a Research Analyst at Dalton Investments and as a Strategy Lead at Coral Labs.

From Engineering to Entrepreneurship

Mohnish Pabrai, an Indian-American businessman and investor, began his road to stardom in obscurity. Pabrai, who was born in Mumbai, India, in 1964, travelled to the United States for higher education2. Between 1986 to 1991, he worked at Tellabs, a technology startup. TransTech, Inc., an IT consulting and systems integration firm, was created by him in 1991 using around US$30,000 from his personal 401(k) account and US$70,000 from credit card debt. Despite early difficulties, Pabrai’s persistence propelled the firm to great success, and he sold TransTech for a whopping $20 million in 2000 to Kurt Salmon Associates.

Investment Career

However, Pabrai’s true passion resided in the realm of investing. His serendipitous encounter with the seminal works of Benjamin Graham and Warren Buffett ignited a spark within him. Their philosophies of value investing resonated deeply with Pabrai, leading him to delve deeper into this realm.

Following the sale of TransTech, Pabrai focused on the financial markets. Warren Buffett and his value investing philosophies greatly impressed him.

Mastering the Art of Value Investing

Armed with newfound knowledge and a burgeoning passion, Pabrai began applying the principles of value investing to his own endeavors. He developed a unique approach centered around the his famous quote “Heads I Win, Tails I Don’t Lose.” This philosophy involved meticulously identifying companies with robust fundamentals and intrinsic value significantly undervalued in the market. This astute strategy allowed him to generate exceptional returns while mitigating risk.

Pabrai’s prowess in value investing propelled him to the forefront of the investment world. He established the Pabrai Funds and the Pabrai Wagons Fund, vehicles through which he invests and shares his expertise with other aspiring investors.

Investment Career Highlights:

Managing Partner of Pabrai Investment Funds: Founded in 1999, these funds are inspired by the original 1950s Buffett Partnerships and have achieved significant success under Pabrai’s leadership.

Portfolio Manager of Pabrai Wagons Fund: Since September 2023, Pabrai has taken on this additional role, further expanding his influence within the investment world.

Founder and CEO of Dhandho Funds: Established in 2014, Dhandho Funds focuses on developing innovative investment products, reflecting Pabrai’s commitment to creative solutions in the financial realm.

Chairman and CEO of Dhandho Holdings: This holding company, founded in 2013, acquires high-quality businesses with strong management teams, demonstrating Pabrai’s focus on long-term value creation.

In 1999, he established the Pabrai Investment Funds, a hedge fund family inspired by Buffett Partnerships. Since its beginning in 20003, his long-only equities portfolio has returned 517 percent, compared to 43 percent for the S&P 500. His success as an investor catapulted him into the spotlight, and he rose to prominence in the financial world. Pabrai’s meteoric growth reflects his strategic thinking, tenacity, and investing ability.

Mohnish Pabrai ‘s Portfolio

Pabrai has three publicly traded equities valued over Rs. 1,156.8 crore. Micron Technology Inc (MU), Brookfield Corp (BN), and Seritage Growth Properties (SRG) are his three largest interests.

Micron Micron is one of Mohnish Pabrai’s top three interests. Pabrai paid $109 million for 1.59 million Micron Technology shares. It accounts for 80.77% of their stock portfolio and is their most valuable holding. The first Micron Technology deal was done in 2018, and since then, he has acquired shares nine times and sold shares three times.

In February 2023, he recorded a lecture in which he said that he is still a Prosus Shareholder. He also reiterated his favourable perspective on Tencent, which he owns through Prosus. Pabrai said in an interview why he sold 77% of his Alibaba shares after purchasing them in 2021 in order to purchase Prosus/Tencent, which he dubbed BABA.

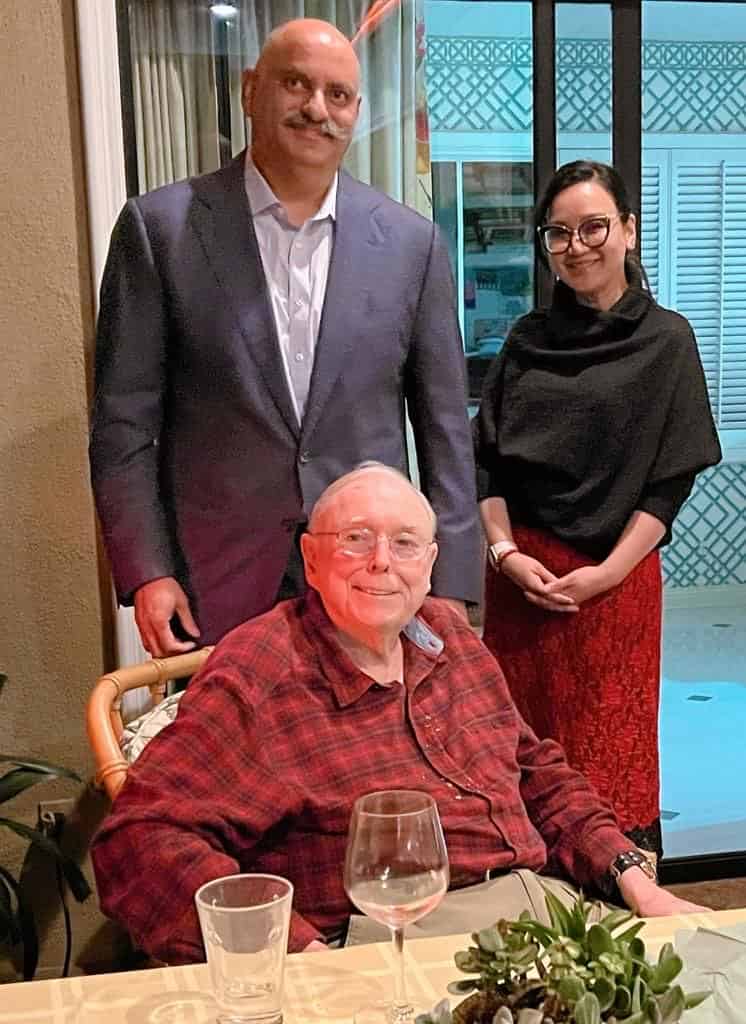

Mohnish Pabrai and Charlie Munger’s Enduring Relationship

In 2007, a shared passion for value investing brought together Mohnish Pabrai and Charlie Munger. Inspired by Munger’s insights, Pabrai sent him a copy of his book, “The Dhandho Investor.” This simple gesture ignited a spark, leading to a deep and enduring friendship that transcended the realm of finance.

Beyond formal meetings, their bond deepened through regular lunches at the Los Angeles Country Club. These gatherings were filled with vibrant discussions, Munger’s wit challenging Pabrai’s perspectives and refining his investment approach. Pabrai, recognizing the immense value of Munger’s experience, frequently sought his counsel on specific investment decisions, gaining invaluable insights from the seasoned maestro.

Their connection extended far beyond the world of finance. A shared fascination with literature, history, and philosophy enriched their lives on a personal level. This mutual interest fostered a deeper understanding and appreciation for each other’s intellectual pursuits, creating a bond that transcended the confines of their professional lives.

The friendship between Mohnish Pabrai and Charlie Munger exemplifies the transformative power of shared passions, intellectual curiosity, and a genuine desire to learn. It stands as a testament to the enduring impact that mentorship can have on one’s life and career, inspiring aspiring investors and reminding us that true connection flourishes when individuals share a common ground of intellectual exploration and shared values.

Mohnish Pabrai: Inspired by Warren Buffet

Mohnish Pabrai’s relationship with Warren Buffett goes beyond mere admiration. Pabrai views Buffett as a guiding light, diligently studying his value investing philosophies and strategies. His book, “The Dhandho Investor,” explicitly references and incorporates Buffett’s principles. While their public interactions have been limited, Pabrai’s regular attendance at Berkshire Hathaway shareholder meetings and his consistent effort to emulate Buffett’s approach demonstrate their intellectual kinship. This shared passion for value investing and Pabrai’s commitment to learning from Buffett continue to guide his investment decisions and contribute to his remarkable success in the financial world.

Controversies In The Life of Mohnish Pabrai

Despite his undeniable success, Pabrai’s path has not been bereft of controversy. His concentrated investment approach and involvement in the 2007 purchase of Berkshire Hathaway “B” shares drew criticism from certain quarters. However, Pabrai has always remained steadfast in his beliefs and investment philosophy, weathering the storms with grace and resilience.

One topic of controversy concerns specific investments within his accounts. Specific assets have been questioned by critics, notably those in firms with minimal public transparency or unorthodox business practices. When these investments underperformed, there was increased scrutiny, leading to charges of overvaluation and poor due diligence.

Furthermore, Pabrai’s vocal support for persons and groups with contentious backgrounds has earned him a lot of flak. His outspoken respect for personalities such as Charlie Munger, notwithstanding Munger’s previous comments on delicate matters, has sparked discussion and discomfort in some circles.

Net Worth

As per data from May 2022, his net worth was projected to be $1.8 billion, while some sources estimated it to be around $120 million in December 2023, and $150 million. His wealth accumulation is primarily due to his astute investments, with significant holdings in corporations such as Micron Technology, General Motors Company, and Bank of America Corporation. Beyond his financial accomplishments, Pabrai is recognized for his charitable endeavors.

He and his spouse, Harina Kapoor, launched the Dakshana Foundation in 2005 with the aim of eradicating poverty in India. Regarding properties, Pabrai’s investment portfolio encompasses stakes in firms like Edelweiss Financial Services Ltd, Rain Industries Ltd, and Sunteck Realty Ltd. His investment approach is centered on identifying highly undervalued companies that have the potential to yield high returns

Dakshana Foundation : Giving Back to Society

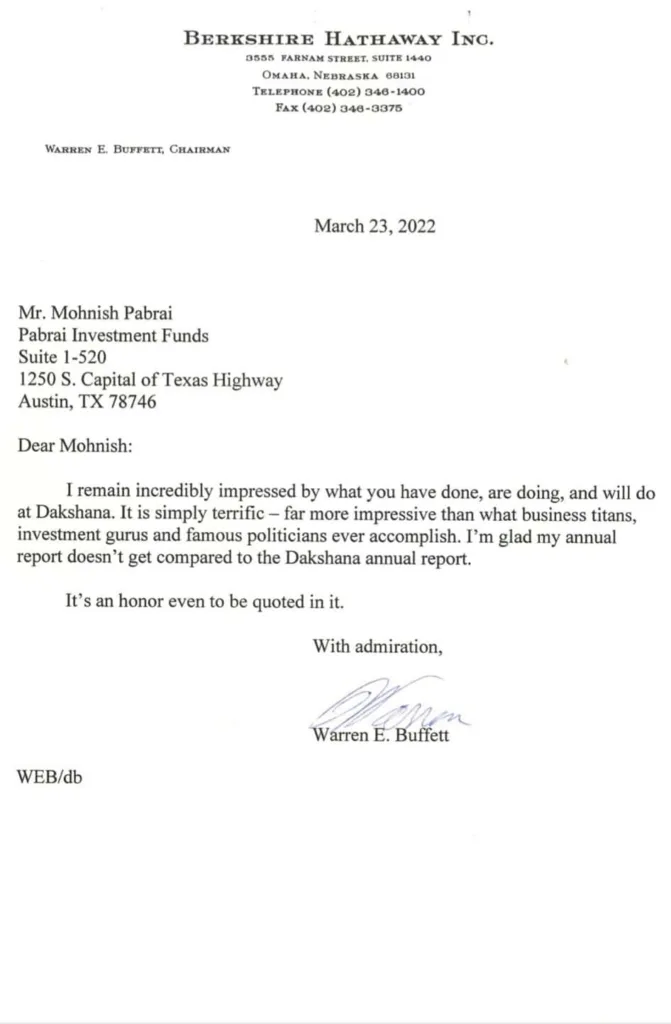

Mohnish Pabrai, consistently showcases a profound dedication to creating positive societal impact through his charitable pursuits. He has done an extremely impressive job with Dakshana Foundation which work for the education of the underprivileged children in India and left the likes of Warren Buffet so impressed that they could not help but express their appreciation.

Pabrai’s altruistic initiatives mirror his conviction in contributing to the greater good and fostering enduring transformations in our world. By co-founding the Dakshana Foundation in 2007, Pabrai has played a pivotal role in providing underprivileged students in India with access to quality education and valuable mentorship, paving the way for them to embark on successful career journeys. The Dakshana Foundation has helped over 1,146 underprivileged students gain admission to prestigious engineering institutions like the Indian Institutes of Technology (IITs).

Beyond Business: An Author, Educator, and Family Man

Mohnish Pabrai’s influence extends beyond investment management, with a keen interest in sharing his knowledge and insights through various mediums. He actively engages with the wider community, serving as a valuable resource for aspiring investors and anyone seeking his unique perspective on the world of finance.

Pabrai has authored two acclaimed books:

“The Dhandho Investor: The Low-Risk Formula for Value Investing” (2011)

“Mosaic: Perspectives on Investing” (2017)

These works offer practical guidance and valuable lessons gleaned from his own extensive investing experience and research.

Guy Spier’s book, The Education of a Value Investor, includes a chapter titled “Doing Business the Buffett-Pabrai Way” that discusses Pabrai’s life philosophy thoroughly.

Beyond books, Pabrai regularly contributes articles to esteemed publications like The Economic Times and Forbes India. These articles often offer insightful commentary on current market trends, investment strategies, and the broader philosophy of value investing. His engaging writing style makes complex financial concepts accessible to a wider audience.

Furthermore, Pabrai actively engages with the community through lectures and presentations. He delivers thought-provoking talks on diverse topics, captivating audiences with his wit, sharp observations, and practical advice. These talks offer valuable insights into his investment philosophy and market outlook.

Overall, Mohnish Pabrai’s multifaceted approach to sharing his knowledge positions him as a prominent thought leader in the investment world. By generously making his wisdom and insights accessible through various mediums, he empowers individuals to navigate the financial landscape and make informed decisions, ultimately contributing to a more knowledgeable and empowered investor community.

The Essence of Mohnish Pabrai: A Beacon of Inspiration

Mohnish Pabrai’s story resonates with aspiring entrepreneurs and investors across the globe. His journey from a young software engineer to a renowned investor serves as a testament to the power of hard work, dedication, and a well-defined investment philosophy. His contributions to the investment world and his unwavering commitment to philanthropy have solidified his position as a role model for future generations. As Pabrai continues to navigate the ever-evolving landscape of finance, his influence and impact on the world remain undeniable.

Reference http://chaiwithpabrai.com