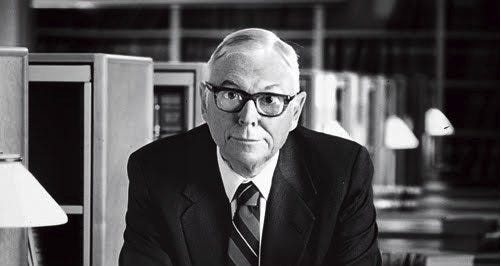

Charlie Munger was a renowned American businessman, investor, and philanthropist who had spent decades accumulating wealth and wisdom. As the vice chairman of Berkshire Hathaway, alongside Warren Buffett, Munger had become an icon in the world of finance and business. Through his writings, lectures, and research papers, he shares valuable insights on investing, business, economics, and personal development.

This article aims to provide a comprehensive overview of Charlie Munger’s works, including books, research papers, and lectures.

Books By Charlie Munger

1. “Poor Charlie’s Almanack” (2005)

This book is a collection of essays and speeches delivered by Munger over the years compiled by Peter D Kaufman. It offers practical advice on investing, business, and personal development, often using humor and anecdotes to make complex concepts more accessible. Some notable chapters include “The Psychology of Investing,” “The Power of Memory,” and “The Importance of Self-Education.”

“Poor Charlie’s Almanack” isn’t a traditional autobiography penned by Charlie Munger himself. Instead, it’s a captivating collection of his wisdom gleaned from speeches, essays, and writings delivered over the years. Compiled by Peter D. Kaufman, the book acts as a treasure trove of Munger’s investment philosophies, laced with humor and real-life anecdotes. It delves into areas like psychology’s influence on investing, the importance of lifelong learning, and the power of a well-honed mental model – offering a unique glimpse into the mind of this legendary investor.

2. “Damned Lies and Statistics: Untangling Fact from Fiction in Business” (2014)

Co-authored with journalist Jarel Harrell, this book focuses on the importance of critical thinking and skepticism when evaluating information in business and economics. Munger emphasizes the need to separate fact from fiction and to question assumptions.

Research Papers by Charlie Munger

1. “The Craft of Value Investing” (2007)

In this paper, Munger explores the principles and practices of value investing, highlighting the importance of patience, discipline, and a long-term perspective. He also discusses the role of emotions in decision-making and how to cultivate emotional intelligence.

2. “A Lesson on Elementary Worldly Wisdom as Viewed from the Principles of Behavioural Economics” (2007)

This paper delves into the principles of behavioral economics, emphasizing the influence of cognitive biases on investment decisions. Munger provides practical advice on how to overcome these biases and make more informed choices.

Lectures by Charlie Munger

1. “The Psychology of Investing” (1994)

In this lecture, delivered at the University of California, Los Angeles (UCLA), Munger discusses the psychological factors that influence investment decisions. He highlights the importance of understanding human behavior and emotions in the context of investing.

2. “A Lesson on Elementary Worldly Wisdom” (2005)

This lecture, given at the University of California, Berkeley, focuses on the principles of worldly wisdom and how to apply them in business and life. Munger emphasizes the value of simplicity, discipline, and a long-term perspective.

Key Takeaways from Charlie Munger’s Works

1. Emphasize the importance of self-education: Munger stresses the need for continuous learning and self-improvement throughout one’s life.

2. Be patient and disciplined: He advises investors to adopt a long-term perspective, avoiding impulsive decisions based on emotions or short-term market fluctuations.

3. Cultivate emotional intelligence: Munger highlights the importance of understanding human behavior and emotions in decision-making, particularly in the context of investing.

4. Question assumptions: He encourages readers to be skeptical and to critically evaluate information before accepting it as fact.

Conclusion

Charlie Munger was a masterful writer, speaker, and investor who had shared his wisdom with the world through various publications and lectures. By studying his works, individuals can gain valuable insights into investing, business, economics, and personal development. Remember to emphasize self-education, patience, discipline, and emotional intelligence in your pursuit of success.

Frequently Asked Questions

Q: What is Charlie Munger’s investment philosophy?

A: Munger is a value investor who believes in adopting a long-term perspective, being patient, and disciplined. He emphasizes the importance of understanding human behavior and emotions in decision-making.

Q: How can I apply Munger’s principles to my personal life?

A: By adopting a similar approach to investing, you can apply Munger’s principles to your personal life by prioritizing self-education, patience, discipline, and emotional intelligence.

Q: What is the significance of Munger’s work in the context of behavioral economics?

A: Munger’s work highlights the influence of cognitive biases on investment decisions. By understanding these biases, individuals can make more informed choices and overcome them through self-awareness and discipline.

Q: Can I find free resources online to learn from Charlie Munger?

A: Yes, many of Munger’s lectures, speeches, and writings are available online for free. You can find these resources on websites such as YouTube, TED Talks, and the University of California’s lecture archives.

Reference : http://www.investopedia.com