In the realm of financial Ratios , the PEG ratio stands as a stalwart metric, offering investors a nuanced perspective on a company’s potential for growth while considering its current valuation. This article delves into the intricacies of the PEG ratio, exploring its definition, formula, components, interpretation, advanced applications, practical examples, and limitations. Let’s embark on this journey to unravel the essence of the PEG ratio and its significance in investment decision-making.

I. What is the PEG Ratio?

The PEG ratio, short for Price/Earnings to Growth ratio, is a valuation metric that evaluates a company’s stock by taking into account both its current earnings and its expected future growth. It serves as a vital tool for investors seeking to gauge whether a stock is overvalued, undervalued, or fairly valued based on its earnings performance and growth prospects.

Definition and Formula:

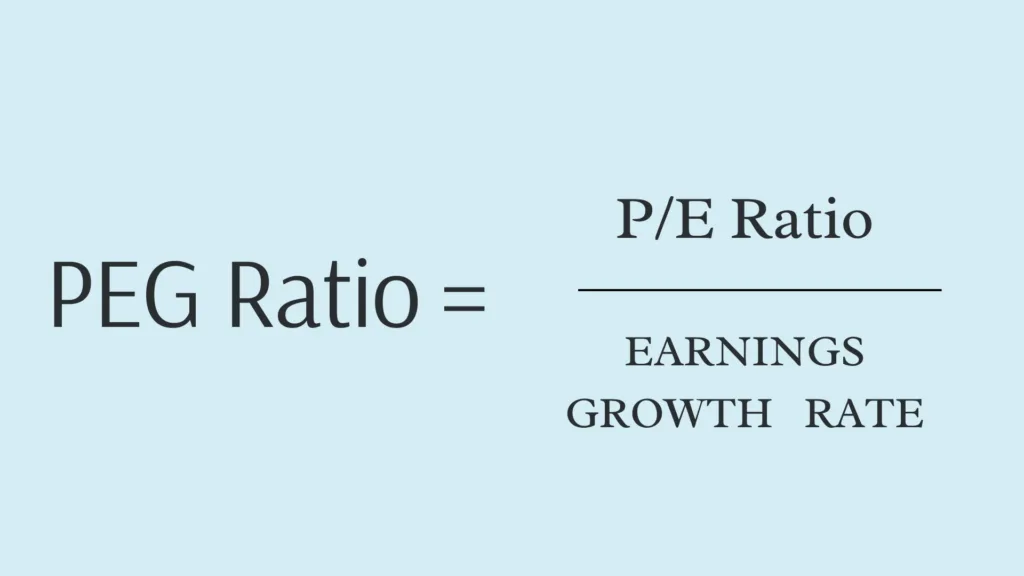

The formula for calculating the PEG ratio is straightforward:

PEG Ratio = P/E Ratio / Earnings Growth Rate

Where:

P/E Ratio: This is the Price-to-Earnings Ratio, which is calculated by dividing the current share price of a company by its earnings per share (EPS).

Earnings Growth Rate: This is the expected growth rate of the company’s earnings per share (EPS) over a specific period, typically 1-3 years.

Here are some additional points to keep in mind:

The earnings growth rate can be historical, analyst estimates, or a combination of both.

There is no definitive “ideal” PEG ratio, but a common benchmark is 1. A PEG ratio below 1 could indicate that the stock is undervalued, while a ratio above 1 could suggest it is overvalued. However, interpretation should be done in context with other factors.

Remember that the PEG ratio is just one tool for stock analysis, and it should not be used in isolation. Other factors, such as the company’s financial health, competitive landscape, and overall market conditions, should also be considered.

Purpose and Benefits of Using PEG Ratio:

The primary purpose of the PEG ratio is to provide a more holistic view of a company’s valuation compared to the traditional P/E ratio. By incorporating earnings growth into the equation, the PEG ratio offers investors insights into whether a stock’s price is justified by its earnings growth potential.

Some key benefits of using the PEG ratio include:

Incorporating Growth: Unlike the P/E ratio, which solely focuses on current earnings, the PEG ratio factors in the expected earnings growth rate, providing a forward-looking perspective.

Comparative Analysis: It enables investors to compare the valuation of different companies within the same industry or sector, considering their growth prospects.

Risk Assessment: By assessing the relationship between a stock’s price, earnings, and growth rate, investors can better evaluate the risk-return profile of potential investments.

Limitations of PEG Ratio:

While the PEG ratio offers valuable insights, it is not without limitations:

Subjectivity and Reliance on Estimates: The accuracy of the PEG ratio depends on the reliability of earnings growth estimates, which can be subjective and prone to error.

Vulnerability to Market Volatility: Rapid changes in market conditions or investor sentiment can impact future earnings projections, affecting the validity of the PEG ratio.

Industry Variability: Different industries may have varying growth expectations and risk profiles, making it challenging to compare PEG ratios across sectors.

II. Understanding the Components of PEG Ratio

A. Price-to-Earnings (P/E) Ratio:

The P/E ratio is a key measure that compares a company’s current stock price to its earnings per share (EPS). It serves as a measure of how much investors are willing to pay for each unit of earnings generated by the company.

The P/E ratio is calculated by dividing the current market price of the stock by its earnings per share (EPS). A high P/E ratio suggests that investors are willing to pay more for each unit of earnings, indicating bullish sentiment or expectations of future growth. Conversely, a low P/E ratio may indicate undervaluation or pessimism regarding future prospects.

Different Types of P/E Ratios:

Trailing P/E Ratio: Based on historical earnings over the past twelve months.

Forward P/E Ratio: Uses estimated future earnings to calculate the ratio, providing a forward-looking perspective.

Normalized P/E Ratio: Adjusts earnings for cyclical fluctuations or one-time events to provide a more accurate representation of the company’s earning power.

Factors Affecting P/E Ratio:

Growth Potential: Companies with high growth potential often command higher P/E ratios as investors anticipate future earnings growth.

Risk Profile: The perceived risk associated with a company’s business model, industry, and overall market conditions can impact its P/E ratio.

Dividend Policy: Companies that pay dividends may have lower P/E ratios due to the distribution of earnings to shareholders.

Market Sentiment: Investor sentiment and market trends can influence stock prices and, consequently, P/E ratios.

B. Earnings Growth Rate:

The earnings growth rate represents the percentage increase or decrease in a company’s earnings over a specific period. It serves as a key determinant in estimating a company’s future profitability and value.

Different Ways to Estimate Earnings Growth:

Analyst Forecasts: Analysts use various methodologies and financial models to forecast future earnings growth based on industry trends, company performance, and macroeconomic factors.

Historical Growth: Examining a company’s past earnings growth can provide insights into its historical performance and potential for future growth.

Importance of Choosing the Right Growth Timeframe:

Selecting an appropriate timeframe for estimating earnings growth is crucial to the accuracy of the PEG ratio. Short-term projections may capture near-term trends but may overlook long-term potential, while long-term forecasts may be subject to greater uncertainty.

Risks and Uncertainties Associated with Growth Estimates:

Estimating earnings growth involves inherent risks and uncertainties, including:

Macroeconomic Factors: Economic fluctuations and geopolitical events can impact business operations and earnings growth.

Industry Dynamics: Changes in industry trends, technological advancements, and competitive pressures can influence future earnings prospects.

Company-specific Risks: Factors such as management quality, product innovation, and regulatory changes can affect a company’s ability to achieve projected earnings growth.

III. Interpreting the PEG Ratio

What Does a Specific PEG Value Mean?

The interpretation of the PEG ratio depends on the value obtained:

PEG < 1: Generally considered undervalued, indicating that the stock’s price is relatively low compared to its earnings growth potential.

PEG = 1: Indicates that the stock is fairly valued, with the price reflecting the expected earnings growth rate.

PEG > 1: Suggests overvaluation, implying that the stock’s price may be too high relative to its earnings growth prospects.

Generally Accepted Ranges for PEG:

While there is no universally agreed-upon range for PEG ratios, investors often consider the following guidelines:

PEG < 1: Potentially attractive investment opportunity.

PEG between 1-2: Fairly valued.

PEG > 2: Potentially overvalued.

Importance of Considering Industry Context and Individual Company Characteristics:

It’s essential to consider industry-specific factors and company-specific attributes when interpreting PEG ratios. Industries with higher growth potential may warrant higher PEG ratios, while mature industries may have lower ratios.

Comparing PEG Ratios Across Different Companies:

Comparing PEG ratios across companies within the same industry can provide insights into relative valuation and growth expectations. However, it’s crucial to consider differences in business models, competitive advantages, and growth trajectories.

Using PEG Ratio in Conjunction with Other Valuation Metrics:

While the PEG ratio offers valuable insights, it’s advisable to use it in conjunction with other valuation metrics, such as the P/E ratio, Price-to-Book (P/B) ratio, and Discounted Cash Flow (DCF) analysis, to find out a fairly good idea of a company’s valuation.

IV. Advanced Applications of PEG Ratio

PEG Ratio Variations:

1. Adjusted PEG: Accounts for factors such as risk, volatility, or market conditions to refine the valuation analysis.

2. Forward PEG: Utilizes projected future earnings growth for a forward-looking assessment of valuation.

Using PEG Ratio for Sector Analysis and Stock Screening:

The PEG ratio can be employed to evaluate entire sectors or industries, identifying opportunities for investment based on relative valuation and growth prospects. Stock screening based on PEG ratios can help investors narrow down their investment choices to companies with attractive valuations and growth potential.

Portfolio Construction Based on PEG Ratio Analysis:

Incorporating stocks with favorable PEG ratios into a diversified investment portfolio can potentially enhance returns while managing risk. By selecting companies with attractive valuations and growth prospects, investors can build a well-balanced portfolio poised for long-term growth.

Limitations of Using PEG Ratio for Individual Stock Selection:

While the PEG ratio provides valuable insights, it has certain limitations when used for individual stock selection:

1. Reliance on Estimates: The accuracy of the PEG ratio depends on the reliability of earnings growth estimates, which may be subject to revision or uncertainty.

2. Market Volatility: Rapid changes in market conditions or investor sentiment can impact future earnings projections, affecting the validity of the PEG ratio.

3. Industry Variability: Different industries may have varying growth expectations and risk profiles, making it challenging to compare PEG ratios across sectors.

V. Practical Example of Using PEG Ratio

Analyzing a Specific Company Using PEG Ratio :

Let’s consider Company X, a leading player in the technology sector. To analyze Company X using the PEG ratio, we’ll follow these steps:

1. Gather Data: Obtain Company X’s current stock price, earnings per share (EPS), and consensus earnings growth forecast.

2. Calculate P/E Ratio: Divide the current stock price by the company’s EPS to determine the P/E ratio.

3. Estimate Earnings Growth Rate: Use analyst forecasts or historical growth rates to estimate Company X’s earnings growth rate.

4. Calculate PEG Ratio: Divide the P/E ratio by the estimated earnings growth rate to obtain the PEG ratio.

5. Interpretation: Assess whether Company X’s PEG ratio suggests undervaluation, fair valuation, or overvaluation based on industry norms and company-specific factors.

Walking Through the Calculation and Interpretation:

Suppose Company X has a P/E ratio of 20 and an estimated earnings growth rate of 15%. The PEG ratio would be calculated as follows:

PEG Ratio = P/E Ratio / Earnings Growth Rate = 20 / 15% = 1.33

Therefore, the PEG ratio for Company X is 1.33.

Interpreting the PEG ratio of 1.33, we can infer that Company X may be slightly overvalued relative to its earnings growth prospects. However, further analysis considering industry dynamics and competitive positioning is warranted to make informed investment decisions.

Potential Limitations and Alternative Insights:

While the PEG ratio provides a useful framework for valuation analysis, it’s essential to acknowledge its limitations, including reliance on estimates, market volatility, and industry variability. Investors should supplement PEG ratio analysis with qualitative research, financial modeling, and risk assessment to mitigate potential blind spots and enhance decision-making.

VI. Conclusion and Key Takeaways

In conclusion, the PEG ratio serves as a valuable tool for investors seeking to assess the relationship between a company’s valuation and its earnings growth potential. By integrating both current earnings and future growth expectations, the PEG ratio offers a nuanced perspective on stock valuation, enabling investors to make more informed investment decisions.

Summary of the Importance and Limitations of PEG Ratio:

The PEG ratio facilitates comparative analysis, risk assessment, and portfolio construction, but it’s not without limitations, including reliance on estimates and market dynamics.

Practical Tips for Using PEG Ratio Effectively:

1. Validate earnings growth estimates through thorough research and analysis.

2. Consider industry context and company-specific factors when interpreting PEG ratios.

3. Use PEG ratio in conjunction with other valuation metrics for comprehensive analysis.

4. Regularly monitor and update valuation assumptions to reflect changing market conditions.

Frequently Asked Questions (FAQs):

1. What is a good PEG ratio?

A PEG ratio below 1 is generally considered favorable, indicating potentially undervalued stocks, while a ratio above 1 may suggest overvaluation.

2. How accurate are PEG ratios?

PEG ratios are as accurate as the underlying earnings growth estimates. However, they are subject to uncertainty and revision, particularly in volatile market conditions.

3. Can PEG ratios be negative?

Yes, PEG ratios can be negative if a company’s P/E ratio is negative or if the estimated earnings growth rate is negative.

4. Is the PEG ratio suitable for all industries?

While the PEG ratio can be applied across industries, its relevance may vary based on industry dynamics, growth prospects, and risk profiles.

5. Should investors solely rely on the PEG ratio for investment decisions?

No, investors should use the PEG ratio as one of several tools in their investment toolkit, complementing it with qualitative analysis, financial modeling, and risk assessment.

Reference : http://www.fools.in